|

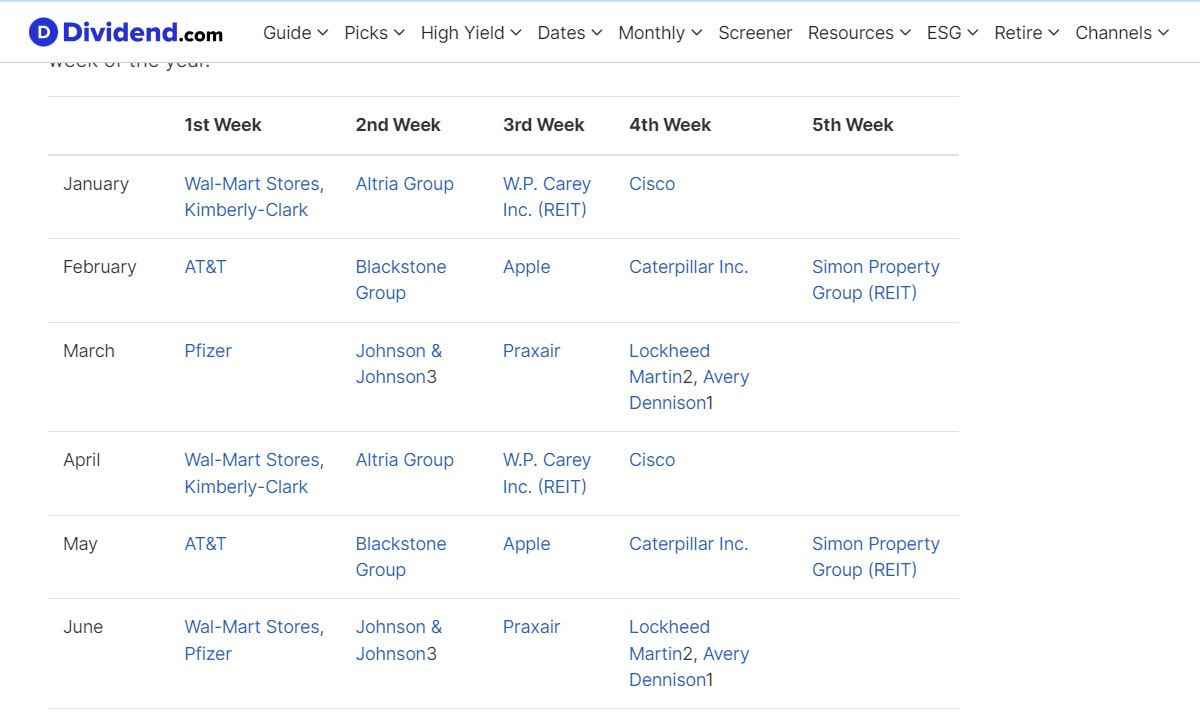

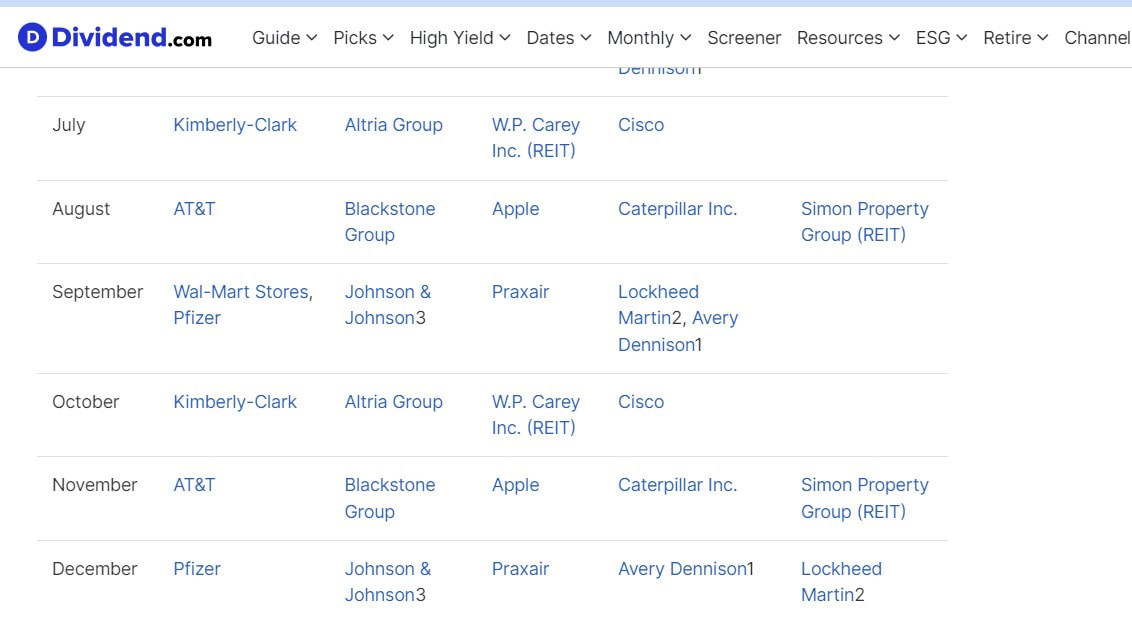

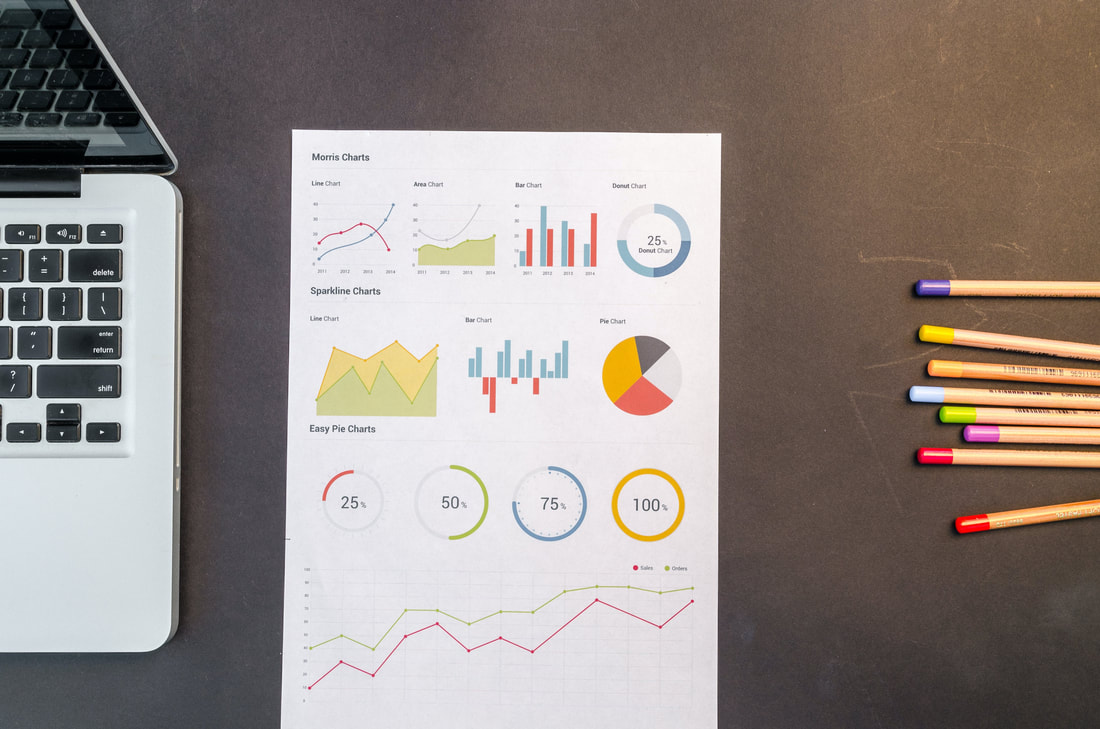

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are of my own and are not to be used as professional advice. These are my findings and can hopefully help you to make informed decisions on investing. Consult a Broker or Lawyer before making any investment. Dividends Every Week of the Year The stock market is full of varying types of investments. One of the most enjoyable investments I have are those that pay dividends. Many of my investments are in ETFs that pay dividends and also individual stocks paying dividends. Article on High-Yielding Dividend ETFs One of the issues that we all have is getting consistent returns. Many stocks pay quarterly dividends, but that does not mean they are at the end of the standard quarters of March, June, September, and December. With a little study, you can get some dividends every month, and now I have found a way to guarantee a dividend every week. A great article was put out by Dividends.com this week on getting paid a dividend every week. Dividend.com Article on Dividends Every Week What is amazing is they figured out how to make it pay every week with just 12 stocks. While some of these are high payers, others are in the lower dividend category. But those that pay the lower dividends many times return growth. Here are the two charts to see the 12 stocks and which pay on which week for the entire year. First pic is first six months. Second is the last half of the year. If you have a lot of dividend paying stocks, you probably own most of these. I do not own Blackstone Group, Praxair, Avery Dennison, Lockheed Martin, Simon Property Group, or Altria Group. I have no issue with any of these on the list except Altria Group as they sell tobacco products. I try to stay away from anything selling tobacco, alcohol, or is involved in gambling. Let your conscience be your guide. I intend to seek out when Altria Group pays their dividend and find another stock that pays on that same time-period. I don’t think that will be too hard. So consider these in your investment portfolio so you can get some consistent dividends every month. I will incorporate this into my Schwab dividend portfolio where I buy what is called Stock Slices. You can spread as little as $5 into a stock if it is listed as being in their group of Stock Slices. Most S&P 500 stocks are there. If not just buy one share of that stock and add to it by the share. Another option is to buy these at Fidelity.com where there is no limitation on what you can buy by the dollar that I am aware of. Keep on studying and finding good ways to increase your monthly dividends. Dividends are my favorite type of Passive Income. Investment Articles Minimalism Articles Internet Direct Laptops

0 Comments

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are of my own and are not to be used as professional advice. These are my findings and can hopefully help you to make informed decisions on investing. Consult a Broker or Lawyer before making any investment. The Total Money Makeover This is definitely the top most important investment book I have ever read. The Total Money Makeover by Dave Ramsey probably is not your normal investment book in relation to how to invest your money. But if I had not read it or adopted his methods of running my personal life, I would never have had the funds to invest the way I do today. In my previous posts, I have explained how I spent years trying to overcome my huge backlog of debt and failed. Finally, I found this book. It is available in most libraries, but if you want a copy, you can buy it on Amazon: The Total Money Makeover Dave Ramsey has coached millions of people on how to live and manage their finances. His way works. Many do not like his method as it is in your face and he sees no reason to ever use a credit card. (Debit cards are fine.) If his approach is too radical for you, you can try your plan by mixing his method and yours. I did it that way for over 10 years, and if I had not finally said “ENOUGH”, I think we would still be battling a huge unwinnable battle. Each day, Dave Ramsey has a talk show and discusses situations people are in. My wife and I try to watch his show at least 5 times a week. His steady consistent Christian world view really makes sense. If you listen, you will realize your situation is probably not as bad as many who call in. But he gives good sound financial advice. Most spoiled people who think they have to have expensive ‘cars and toys’ find out quickly that he will make you discard those. But hanging on to something you probably should never have bought is not part of his no-nonsense plan. Many like myself got into an over-my-head debt situation by digging a hole with credit cards. Dave Ramsey’s advice is that if you are in hole, stop digging. In simple words, STOP using credit cards. A study of credit card use at McDonald’s found that people spent 47% more when using credit instead of cash. Credit cards give you a false sense of having more money than you truly have. The Total Money Makeover is not just a book of theories. It is a proven reliable method to take on your debt head-on and come out debt-free in as little as 18 to 24 months. Mine was so great it would probably have taken 5 years to use his method. By using part of his methods, we did it in 10 years. However, when we fully adopted the Dave Ramsey method, we were debt-free in 11 months. Dave Ramsey probably has been where you are traveling today. He details how he became a millionaire quickly, and they blew it all and became broke. He got on his path to recovery and got back to being a millionaire several times over. Listen to some of the takeaway highlights I have gleaned from his book. Takeaway # 1 - The problem you are facing is probably not a lack of knowledge. Knowing what to do is 20% of it, DOING IT is 80%. The problem is looking you back in the mirror each day. The issue is YOU. You must get control of things and handle the issue. The cavalry is not coming. If you don’t do a total money makeover, you may wind up with an “Alpo” dinner in your old age. Sounds gross, but if you can’t afford food, you might reach such desperate straits. Takeaway # 2 - You must have a sound financial system. Anyone can blow more money than they make. But a solid plan will work day in and day out. He quotes great investor Warren Buffett who says “When the tide goes out, you can tell who was skinny dipping.” In other words, if you don’t have your finances in control, the ups and downs of life may destroy you. And this goes for investments down the road too. Get on a fully diversified SOLID plan once you are at the point to invest. Takeaway # 3 - Dave Ramsey said in his book that he has never met a millionaire who said they got to their lofty status by using Discover points. I was the world’s worst about thinking the ‘right’ credit card would save me money. Paying 18 to 23% interest is not something this is a help to you. Credit cards are NOT YOUR FRIEND. He points out that you and I probably don’t own any of those 20-story shiny buildings, do we? But Discover bondage and Visa and Mastercard and American Express own hundreds of them. Credit cards are NOT YOUR FRIEND. In his book, Dave points out that CHANGE IS PAINFUL. We won’t change until the pain of where we are exceeds the pain of change. When it comes to money, we can be like the toddler in a soiled diaper. “I know it smells bad, but it’s warm and it’s mine.” But the rash comes eventually and we cry out. Until you have had it trying to do it on your own, you will not win. The Credit card companies have you where they want you. Culture and commercials point to a very different picture than reality. Takeaway # 4 - The Baby Steps 1 and 2 of the 7 Baby Steps to Freedom. This is all about HOW to get things under control. You quit living above your means and you stick to a budget. All expensive toys are liquidated and you drive an old Buick or Honda. (I drove both). Baby Step 1 – Save $1,000 for your starter Emergency Fund. Little expenses come up all the time. If you rely on credit cards, you revert to your old ways and soon you have a bill you can not pay. First, you stop paying anything but your basic bills and minimum credit card payments, and you save up $1,000 to use for emergencies. As Dave says in his book, Murphy (Murphy’s law) does not visit people as often when they are prepared for emergencies. If you have to replace your water heater and spend $400 of your emergency funds, you stop your snowballing (Step #2) and refill your emergency fund. Baby Step 2 - This is the second most important thing in getting out of debt. You list all your debts that you owe, the smallest payoff to the highest. He tells you to not be concerned with interest rates, but to worry about wiping out that first lowest debt. You pay the minimum payments on all the rest and pay all you can on the top debt Once it pays off, roll that money into #2 and it becomes the snowball until all 8 or 10 on the list are eliminated. This really really works from my own experience. You see immediate results and it is encouraging. Dave Ramsey encourages you at this point to revaluate everything, and if you have expensive cars that won’t pay off in 2 years or sooner, then sell those vehicles and drive a cheaper car until you get on your feet. Have a garage sale or get an extra job to help with your snowball. This works great! Takeaway #5 – Baby Steps 3 through 5. Now that your credit card debt is finalized, you come back and get organized with your finances. Baby Step 3 – Save 3 to 6 months of expenses in a fully-funded emergency fund. This is not in an investment account, but rather a readily accessible savings account. Baby Step 4 – Invest 15% of your household income into a retirement account. If you have an employer match on your 401K retirement account at work, you put the full matching amount of money there. If you have additional money left to invest, open a ROTH Ira. That way future earnings will never be taxed. Dave Ramsey recommends buying several mutual funds spread over several growth sections. Find those with 5 and 10-year averages of 12 to 15% on returns. Magazines such as Kiplinger’s and Money Magazine list these, as well as all the big brokerage houses like Fidelity, Schwab, and Vanguard. Baby Step 5 – Save for our children’s college fund. Takeaway # 6 - The Baby Steps 6 and 7. Baby Step 6 – Pay off your home mortgage. This gets you 100% debt free from all creditors. Throughout the book, Dave talks about being Gazelle intense about debt. Read that article when you get the book and realize that the gazelle is not too fast, but he is running for his life. You are too when in these baby steps. He found that families who stayed Gazelle intense about debt were out of mortgage debt in approximately 7 years after they declared war on culture and debt. Baby Step 7 – Build wealth and give. When you reach Baby step 7, you can now live like no one else. You are free to truly live a debt-free relaxing life. Takeaway # 7 - The results: You may read this and say, this plan is too simple. I have been there and done that. I tried multiple variations of Dave Ramsey’s plan including funding my Roth IRAs while in baby step 2. It just does not work. What should have taken me 5 years took me more like 10 because I would not conform to his plan. There is something about being TOTALLY FOCUSED on that one baby step until it is done that makes you more determined. As Dave says over and over “Don’t give up.” There will be down moments when it seems like you are not getting anywhere. But make a graph or a pie chart and shout out when you finish even a percentage of one of the steps. Baby Step 2 on the snowball may take you 2 years, or if you are in horrible shape, it might take 6 years. But it is worth the trouble You will be glad you found this book. If like me, you may just need a little simple guidance to get debt-free. It has been the most liberating thing I have ever experienced regarding finances. Look at the millions of people who have stuck with it and can testify that this plan works. Watch his show on You Tube and after a few weeks, you will see that this plan works. In conclusion, let me say that I am so proud to have met Dave Ramsey. He has been a blessing to millions of people (like myself) who have struggled with debt. This is a great book and while not some super important get-rich-quick investment book, it gives you a foundation to get in a position where you can invest and put your money in long-term safe investments.

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are of my own and are not to be used as professional advice. These are my findings and can hopefully help you to make informed decisions on investing. Consult a Broker or Lawyer before making any investment. Some High Yielding Dividend ETFs There are few things nicer in life than to see monthly dividends pour in from your Dividend Stock investments. The problem with that is that you have to constantly monitor the returns and quality of each company to be sure the stock is still a sound investment. One of the easier methods to avoid this issue is to invest in ETFs (Exchange Traded Funds) that pull in a large universe of dividend stocks and still give good solid returns. Upfront I want to say that I still buy dividend stocks in my Schwab IRA every month. But I have expanded out in my investments and now purchase a large number of ETFs that are doing a great job of making a consistent monthly dividend. Some of these pay dividends every month instead of just quarterly. Some of the best dividend stocks come from the lists of Dividend Aristocrats and Dividend Kings. Read the associated articles if you are not familiar with them. These are some of the most highly successful companies that have increased their dividends over 25 years (Aristocrats) and over 50 years on Dividend Kings. The criteria are not the same to make up the lists, so read carefully before making any investing decision. Article on Dividend Aristocrats Article on Dividend Kings Just being on either list does not necessarily make them a good investment, but those on both lists certainly should be considered. I try for at least an 8% return on both the dividend and stock growth. (Stock growth being the increase in stock price yearly). Not all will return that well, but some will do even better. The ETFs that I am writing about today are those that do invest in Dividend stocks and have paid consistent dividends. One of my favorites is NOBL (Pro Shares S&P 500 Aristocrats. It is based on investments in the Dividend Aristocrats. Here is a list of several ETFs that I own. Not necessarily in any order, just ones that stand out as consistent returning Dividend ETFs. FDVV – Fidelity High Dividend ETF DHS - Wisdom Tree U S High Dividend HDV – I Shares Core Hi Dividend ETF DGRO – I Shares Core Growth Dividend SDIV – Global X Super Dividends LVHD – Legg Mason Low Volatility Hi Div ETF I have 4 that have really done well. These are based on using covered calls to increase their returns. These 4 have consistently paid 12% or more. I have QYLD in all 3 of our biggest Roth IRAs. QYLD – Global Nasdaq 100 cov call ETF XYLD – Global X S&P 500 Covered Call JEPQ – J P Morgan Nasdaq Equity Income JEPI - J P Morgan ETF Income Fund Those in the first list may use covered calls to increase their dividends, but I am unsure. SDIV has been high consistently so they probably do. Buying an ETF has a lot of advantages. The person overseeing the managed ETFs makes the decisions on which stocks to purchase. (Not all ETFs are managed… some are based on simple grouping of investment types. ) For example VTI is the whole stock market as well as ITOT and SCHB. I have investments in all 3 of those. But the great thing about ETFs is they give you diversification with many stocks. It is much like a mutual fund but without the 2% management fee. While doing research for this article, I came across a list of the top 100 highest-paying ETFs regarding selling price. Remember that these are not necessarily Dividend ETFs, but have shown the greatest returns overall. I am unsure exactly how they came up with this list, so be wary. 100 High Returning ETFs I have not researched any of these but some on my two dividend lists are in this grouping. Two that particularly stood out to me on Bonds with great returns were TLTW and HYGW. First is on treasury bonds and second is on Corporate bonds. I will be looking into those later this week. As I always urge, get investment advice from a seasoned investor or lawyer. These are just examples of some ETFs that have performed well for me. I wish you much success in your investing endeavors. List of All Investment Articles List of all Minimalism Articles Internet Direct Laptops

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are of my own and are not to be used as professional advice. These are my findings and can hopefully help you to make informed decisions on investing. Consult a Broker or Lawyer before making any investment. The Little Book of Common Sense Investing - Jack C. Bogle About 12 years ago, I read the book “The Little Book of Common Sense Investing” by the late Jack C. Bogle. Jack C. Bogle was one of the great minds in the investment world and his Vanguard group of investments is still one of the best. Mr. Bogle died in 2019, but his legacy lives on. He was the first person to create a full index Mutual Fund using the full stock market as its basis. Today many ETFs try to mimic his designs. Three great ETFs (Exchange Traded Funds) that I have owned for years are the I-Shares ITOT, the Vanguard full stock market index VTI, and the Schwab Full Market Index SCHB. Another great one that is not the whole market but is the S&P 500 that is doing great is the Vanguard VOO. I read this week that renowned investor Warren Buffett has instructed his estate to invest his money into VOO giving you an idea of how much Warren Buffett regards this Vanguard ETF. No investment book has ever affected me as much as The Little Book of Common Sense Investing. I have used full stock market ETFs for the past 12 years in at least 25% of my portfolio. Probably the years that I used them for 50% were the years I had the best returns, so don’t discount the importance of reading this book. Here are some of the insights I gained from The Little Book of Common Sense Investing. 1. In his book, he explained that only 2% of the people making marketing decisions on Mutual Funds can outperform the full stock market index. And if you invest your money with one of those in the top 2, next year they will not be in the top 2% slot. One exception to that rule was Peter Lynch and his fantastic Fidelity Magellan fund. He consistently outperformed the market for many years. But the truth of the matter is that no matter how smart you are, you are hard-pressed to beat the ‘average’ of the whole stock market. I really took this to heart and over the past 12 years, the full stock market ETFs in my portfolio have outperformed all my other investments. 2. Successful investing is all about common sense. Coming up with a completely concise solid plan and sticking to it is a theory for success. A person moving money in and out of the market does not normally make as much as the person who has a fully diversified plan and sticks to it. Simple arithmetic suggests and history confirms that the winning strategy is to own all of the nation’s publicly held businesses at a very low cost. This way you receive all their dividends and share in earnings growth. 3. Over the past century, corporations have earned a return on their capital of 9.5% per year. If you compound that over a decade, each $1 invested goes to $2.48, in 20 years $5.14, 30 years $15.22, and 50 years: $93.48. Think of what compounding does for you. $1 invested in the average in fifty-years grows over 90 times its initial value. Capitalism works and creates wealth. 4. Scattered throughout the book are little boxes with the heading “Don’t Take my Word for It” and Mr. Bogle has industry leaders speak out on their opinion of the full stock market index. It would take a 20-page review to list them all, so I will just pick a few. Jack R. Meyer, former President of Harvard Manage Company said this. (He took the Harvard Endowment Fund from $8 billion to $27 billion during his management.) The investment business is a giant scam. Most people think they can find managers who can outperform, but most people are wrong. I would say 85 to 90% of managers fail to match their benchmarks. Get diversified. Come up with a portfolio that covers a lot of asset classes. And keep your fees low. 5. Princeton professor Burton G. Malkiel, author of A Random Walk Down Wall Street expressed his view: Index funds have regularly produced rates of return exceeding those of active managers by close to 2 percentage points. 6. Peter Lynch, legendary manager of the Fidelity Magellan Fund said in Barron’s Magazine “The S&P is up 343.8 for the last 10 years. General equity funds are up an average of 283 percent. So it’s getting worse and the deterioration by professionals is getting worse. “The public would be better off in an index fund.” 7. Tyler Mathisen, then executive editor of Money Magazine, conceded the point. “For nearly two decades, Jack Bogle, the tart-tongued chairman of the Vanguard Group, has preached the virtues of index funds—those boring portfolios that aim to match their performance of the market barometer. Well, Jack, we were wrong. You win. Settling for the average is good enough for a substantial portion of most investors’ stock and bond portfolios. So what can we conclude from this book? Believe that the average is the way to go using full stock market indexes. I have proven it in my portfolio for the last 12 years. Over the past 15 years, the stock market has consistently put out average yields above 12%. Get a plan of action, and then hold the market portfolio forever. That is what the index fund does. The investment philosophy is not only simple but elegant. The arithmetic on which it is based is irrefutable, but it takes discipline to stick with even a simple plan. Consider the full stock market indexes in your investment plans. I try to keep at least 25% of my investments in full stock market indexes and have had great success with them over the past 12 years. Right now in these days when we have these massive losses on the market, it is a good time to consider buying in on some of the full stock market indexes or buying in on some mutual funds based on full stock market indexes. All this information is for your reading enjoyment. No one can predict the future, but if history repeats itself (and many times it does), then a good long-term bull market may be around the corner. List of All Investment Articles List of all Minimalism Articles Internet Direct Laptops

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are of my own and are not to be used as professional advice. These are my findings and can hopefully help you to make informed decisions on investing. Consult a Broker or Lawyer before making any investment. The Power of Full Market Indexes The stock market is full of varying types of investments. Few make more money in the long haul than the Full Stock Market Indexes. About 12 years ago, I read the book “The Little Book of Common Sense Investing” by the late Jack Bogle. Jack Bogle was one of the great minds in the investment world and his Vanguard group of investments is still one of the best. In his book, he explained that only 2% of the people making marketing decisions on Mutual Funds can outperform the full stock market index. And if you invest your money with one of those in the top 2, next year they will not be in the top 2% slot. One exception to that rule was Peter Lynch and his fantastic Magellean fund. He consistently outperformed the market for many years. But the truth of the matter is that no matter how smart you are, you are hard-pressed to beat the ‘average’ of the whole stock market. I really took this to heart and over the past 12 years, the full stock market ETFs in my portfolio has outperformed all other investments. Over the past 15 years, the stock market has consistently put out average yields above 12%. Years like 2022 are a misnomer in that we have so many things wrong in our world that there is no consistency to the market. Schwab investments printed an article two weeks ago about the 2022 phenomena where both the stock market and the bond market lost money. This has only happened twice in the history of the stock market. 2023 was a good year for the stock market and 2024 is starting out good also. Back to the article for the day, why are full market indexes so wonderful? You get the best of it all. You are fully diversified over the entire market. So in a good year, you should see a 12 to 14% average if history repeats itself. There is no guarantee that it will, but people who stick with the market in both ups and downs seem to make the most money. Three great ETFs (Exchange Traded Funds) that I have owned for years are the I-Shares ITOT, the Vanguard full stock market index VTI, and the Schwab Full Market Index SCHB. Another great one that is not the whole market but is the S&P 500 that is doing great is the Vanguard VOO. I read this week that renowned investor Warren Buffett has instructed his estate to invest his money into VOO giving you an idea of how much Warren Buffett regards this ETF. Another good S&P 500 ETF is SPY. Are these locks for profits? Not at all. But over time, I think you will find these to be some of the most steady and consistent investments. I have not been able to prove it yet, but I think that DGI investing may yield a bit more than the full stock market indexes, but only time will tell. DGI stands for Dividend Grow Investments. You are zeroing in on stocks that have long-term market increases of dividends with the ability to grow in value. Check out article on DGI investing. Consider the full stock market indexes in your investment plans. I try to keep at least 25% of my investments in full stock market indexes and have had great success with them over the past 20 years. Investment Articles Minimalism Articles Internet Direct Laptops

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are of my own and are not to used as professional advice. These are my findings and can hopefully help you to make informed decisions on investing. Consult a Broker or Lawyer before making any investment. All of us have to start somewhere with investing. I have found that you can be successful in investing in many different ways. Some people want to simply put their money to work and do not want to be involved in any decisions. Let's begin by discussing how to invest in the stock market. SIMPLE NO INVOLVEMENT One of the easiest methods is to use a robo-type investment platform. One that my wife and I use is www.wealthfront.com We both have Roth IRAs at Wealthfront, and they let you decide the level of risk you want to take. As money comes in, they set the percentages to allow you to have a diversified portfolio. As certain categories grow, they reallocate your money to keep so much in safe investments like Bonds or Dividend Stocks. SELF DIRECTED ROTH IRA One of the best plans is to open an account at a brokerage that has no fees involved. We have accounts at Fidelity.com and Schwab.com, Each brokerage has its own advantages. One of the great things about having a self-directed account is that you are free to setup your own balances as to how much you want in stocks, bonds, and mutual funds. We will go over each of these in a future article explaining some simple methods to get diversified to help offset turbulent waters in the market. In early 2024, some stocks have actually dropped in price, but it is crucial to stay invested. According a recent article by Fidelity, the people who stay the course through the ups and downs of the market make the most money. Trying to time the stock market is virtually impossible. So full market indexes using ETF's are a great long-term strategy. People like Peter Lynch (Long time successful investor at Fidelity with the Magellan Fund) and Warren Buffet both have stated that when everyone else is selling, it is probably a good time to buy. Dollar-cost averaging makes you have a bigger profit when the market starts back up. We will cover all these topics in future articles. Remember that you must have earned income to contribute to an IRA. You can contribute up to $6500 of earned income per year to either a Roth or Traditional IRA. (More if you are over 60 years of age.) The difference in the the two types of IRAs is that a Traditional IRA lets you have a tax advantage as you do not have to pay taxes on the contributions until you withdraw the money. On a ROTH IRA, there is no tax advantage as you pay the taxes on the money contributed. But it is really a far better plan as all distributions taken are tax-free if taken after you are 59 ½ years old. Also there are no RMDs on Roth IRAs. RMDs are Required Minimum Distributions. Check with a tax professional to determine what is best for you and your family. Investment Articles Minimalism Articles Internet Direct Laptops

HAVING A STRONG UNMOVING MINDSET

DISCLAIMER - I am not a Financial Advisor and do not work for any Brokerage Firm. The opinions given are of my own and are not to be used as professional advice. These are my findings and can hopefully help you to make informed decisions on investing. Consult a Broker or Lawyer before making any investment. All of us have to start somewhere with investing. I have found that you can be successful in investing in so many different ways. Some people want to simply put their money to work and do not want to be involved in any decisions. Let's begin by discussing how to invest in the stock market. SIMPLE NO INVOLVEMENT One of the easiest methods is to use a robo-type investment platform. One that my wife and I use is www.wealthfront.com We both have Roth IRAs at Wealthfront, and they let you decide the level of risk you want to take. As money comes in, they set the percentages to allow you to have a diversified portfolio. As certain categories grow, they reallocate your money to keep so much in safe investments like Bonds or Dividend Stocks. SELF DIRECTED ROTH IRA One of the best plans is opening an account at a brokerage with no fees involved. We have accounts at www.Fidelity.com and www.Schwab.com, Each brokerage has its advantages. One of the great things about having a self-directed account is that you are free to set up your balances as to how much you want in stocks, bonds, and mutual funds. We will go over each of these in a future article explaining some simple methods to get diversified to help offset turbulent waters in the market. In early 2024, some stocks have dropped in price, but it is crucial to stay invested. According to a recent article by Fidelity, the people who stay the course through the ups and downs of the market make the most money. Trying to time the stock market is virtually impossible. So full market indexes using ETFs are a great long-term strategy. Article on how to start investing with $100 using ETFs. People like Peter Lynch (Long time successful investor at Fidelity with the Magellan Fund) and Warren Buffet both have stated that when everyone else is selling, it is probably a good time to buy. Dollar-cost averaging makes you have a bigger profit when the market starts back up. We will cover all these topics in future articles. Investment Articles Minimalism Articles Internet Direct Laptops

S.M.A.R.T. Goals for 2024 Some think resolutions are pointless. But the bible is clear we should have plans and look to God daily for help. I have read that only 3% of people make goals, but those 3% accomplish more than the 97% who do not. My wife Denise and I have had clear written goals over the past 3 years which I put on the wall. Writing it down makes you 42% more likely to achieve the goal than to just speak it. With clearly written goals, there is a clear target to hit. Without a goal, you will hit it every time. But by having written goals, we have been able to meet those goals for 3 consecutive years. The Dictionary says the definition of resolution is: Resolution noun

3. A course of action determined or decided on. "His resolution is to get up early." The word Goal is similar to Resolution. Goal noun

Just reading books means nothing, but reading books that grow your mind and thinking can be helpful. No book helps me more than the bible itself. But of the others that have really helped me this year are books related to Habits and Mindset. One of them is Keystone Habits by Steven Shuster. In this book, he discusses making S.M.A.R.T. goals. SMART is an acronym tied to a word for each letter. S – Specific M – Measurable A – Attainable R – Relevant T – Timely Think on those a few minutes. Specific, Measurable, Attainable, Relevant, and Timely. What causes us to fail on resolutions is not following those rules. Thousands of people decide in the first week of January to lose weight. And they normally do well for a couple of weeks. Exercise gyms and people selling those exercise machines do a lot of business in January. But by February, most of those resolutions are gone. Why is that? Because they are not meeting those 5 criteria of S.M.A.R.T. Don’t just say I will lose weight. Set a specific goal. For instance, say I will lose 1 lb. each month. That makes it reasonable and attainable. It is a SPECIFIC goal. The reason for failure is not having clear written goals. I was thinking on that acronym and the S could mean a lot of things that would make sense. Steady, Systematic, Smart, Secure, Slow, or Steadfast. But he chose to use Specific, and we need to be specific. I like having clear and precise goals. Pray about what you are desiring, and be sure it is in God’s will. If your goal is reasonable and in God’s will, nothing can hold you back from accomplishing it. When the 5 men of the tribe of Dan went into the land to spy it out, they came to the house of Micah and asked for guidance of Micah and his priest. Jdg 18:5 And they said unto him, Ask counsel, we pray thee, of God, that we may know whether our way which we go shall be prosperous. Like them, we need to seek God’s face. And when we know God’s will, nothing shall hold us back. Mat 7:7 Ask, and it shall be given you; seek, and ye shall find; knock, and it shall be opened unto you: Mat 7:8 For every one that asketh receiveth; and he that seeketh findeth; and to him that knocketh it shall be opened. In the book of James, we have instructions on how to seek wisdom. Jas 1:5 If any of you lack wisdom, let him ask of God, that giveth to all men liberally, and upbraideth not; and it shall be given him. Let us read all 6 of those verses beginning in verse 2. Jas 1:2 My brethren, count it all joy when ye fall into divers temptations; Jas 1:3 Knowing this, that the trying of your faith worketh patience. Jas 1:4 But let patience have her perfect work, that ye may be perfect and entire, wanting nothing. Jas 1:5 If any of you lack wisdom, let him ask of God, that giveth to all men liberally, and upbraideth not; and it shall be given him. Jas 1:6 But let him ask in faith, nothing wavering. For he that wavereth is like a wave of the sea driven with the wind and tossed. Jas 1:7 For let not that man think that he shall receive any thing of the Lord. Plan out your year. Write down your goals and make them specific and measurable and attainable. I believe with God’s help we can all attain our desires using S.M.A.R.T. goals. S – Specific M – Measurable A – Attainable R – Relevant T – Timely List of All Investment Articles List of All Minimalism Articles Internet Direct Laptops

|

David ParhamChristian Minimalist and Investor. God guides and helps me everyday. Archives

May 2024

Categories |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

RSS Feed

RSS Feed